Today, about 90% of public SaaS companies and the 2019 Forbes Cloud 100 have subscription-based revenue models. Now new fintech infrastructure companies have made it possible for SaaS businesses to add financial services alongside their core software product. By adding fintech, SaaS businesses can increase revenue per customer by 2-5x* and open up new SaaS markets that previously may not have been accessible due to a smaller software market or inefficient customer acquisition.

This wave is happening first in vertical markets (meaning the market around a specific industry, such as construction or fitness). Vertical software markets tend to have winner-take-most dynamics, where the vertical SaaS business that can best serve the needs of a specific industry often becomes the dominant vertical solution and can sell both software and financial solutions to their core customer base. Moreover, while early vertical SaaS companies – Mindbody, Toast, Shopify – typically started by reselling financial services (primarily payments), they are now embedding financial products beyond payments – from loans to cards to insurance – directly into their vertical software.

In this post, we will look at why fintech is driving the next evolution of vertical SaaS, why it opens new vertical markets, and where and how different business models for fintech can be applied.

TABLE OF CONTENTS

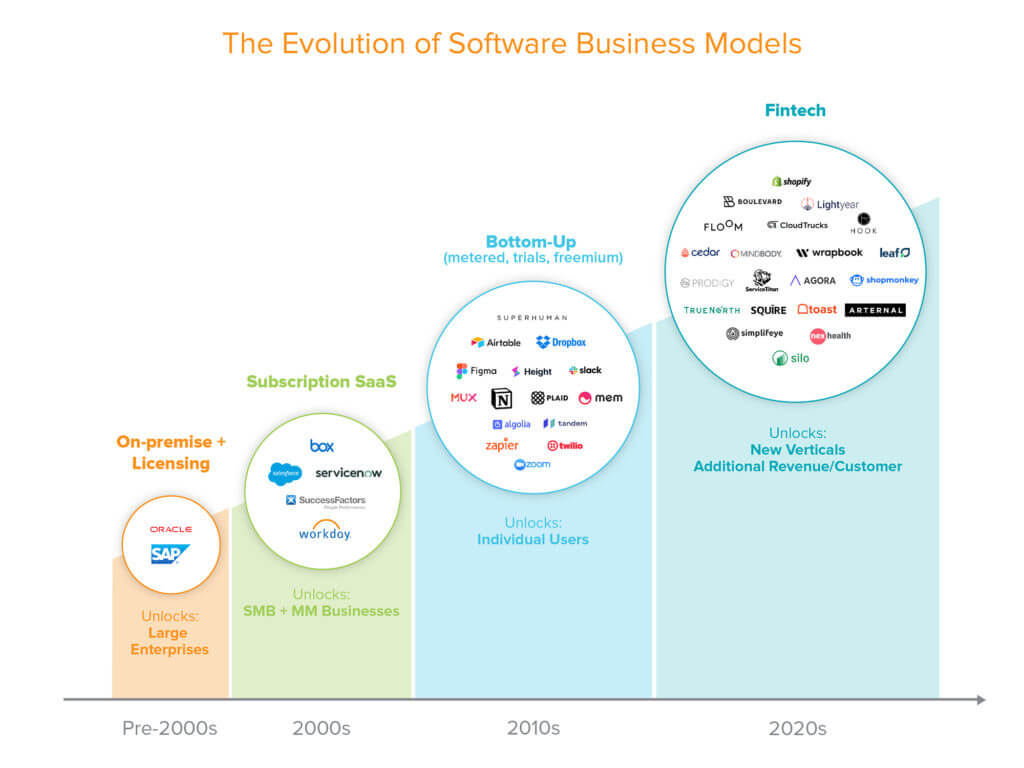

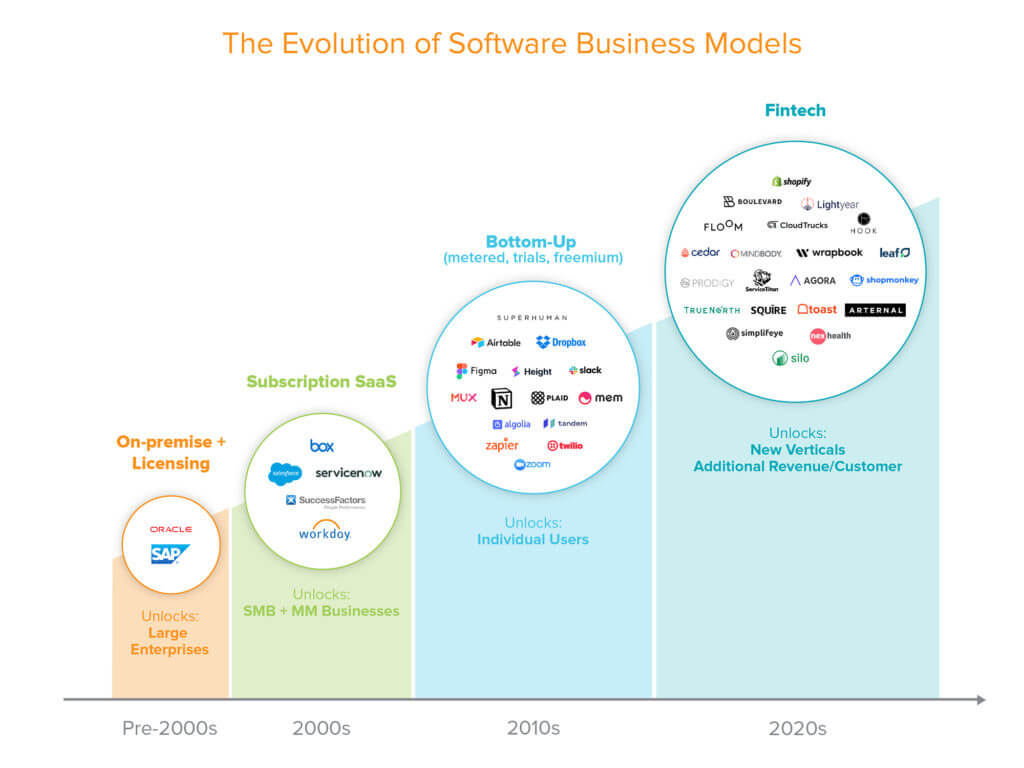

Every 10 years or so, we evolve how software is distributed and sold. Each evolution – from on-premise to subscription and bottom-up – has unlocked new markets and grown the overall software market. Until now, these software business models expanded the overall market by growing the user base, from large enterprises to small- and medium-sized businesses (SMBs) and midmarket companies to individual users. But the fintech business model increases the overall market for software in two additional ways:

Vertical markets are particularly good candidates for a SaaS+fintech business model. While customers in horizontal markets often try different software vendors, resulting in multiple winners in a market segment, customers in vertical markets prefer purpose-built software for their specific industry and use cases. Once one software solution demonstrates its value, the customer base will consolidate around that company for all its software needs. As a result, vertical SaaS businesses are able to quickly become the dominant solution in a particular industry – for example, Veeva, a CRM for pharma, has over 50% market share – and then layer on additional products (software and financial). Servicetitan began by offering software to home services businesses, but it has since layered on financial products such as payments and lending.

Let’s assume the average vertical SMB customer spends about $1,000/month on software and services. Of that, $200 per month will typically be on traditional software (e.g., ERP, CRM, accounting, marketing), and the rest on other financial services (e.g., payments, payroll, background checks, benefits). In a traditional vertical SaaS business, the only way to capture more revenue from the customer was to upsell software. This left the $800 per month potential revenue from financial services to other vendors.